Every year, shoppers eagerly await Black Friday and Cyber Monday to catch the best deals. Investors on the other hand, keep an equally sharp eye on these events, but for a different kind of discount. These two retail extravaganzas aren’t just about filling up carts; they give valuable clues about consumer spending and market trends. But here’s the million-dollar question: Black Friday vs. Cyber Monday, which of these shopping holidays has the bigger impact on the stock market?

In this article, we’ll break down how these two days compare, explore why they matter so much to investors, and highlight the stocks that deserve a spot on your watchlist.

The Black Friday vs. Cyber Monday Showdown

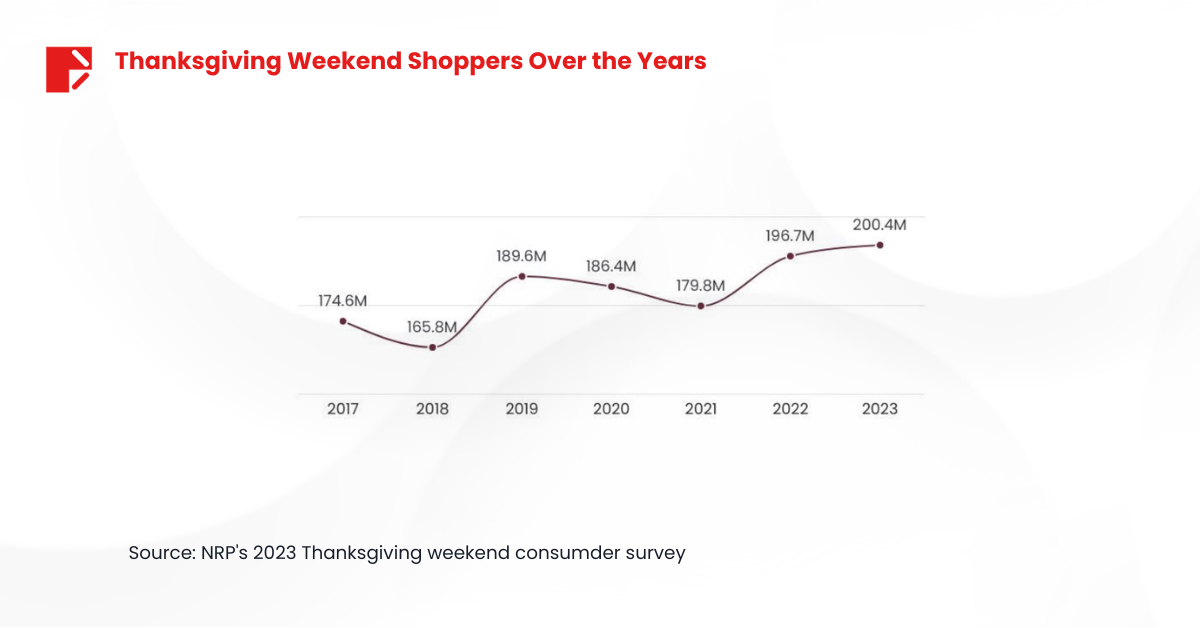

According to the National Retail Federation (NRF), in 2023 a record 200.4 million consumers shopped over the five-day holiday weekend from Thanksgiving Day through Cyber Monday, surpassing 2022’s record of 196.7 million.

Black Friday marks the beginning of the holiday shopping season, often associated with physical store sales, although online shopping now plays a major role. Black Friday has traditionally been a barometer for brick-and-mortar stores like Walmart (NYSE: WMT) and Target (NYSE: TGT), which roll out aggressive deals to lure shoppers.

Cyber Monday, on the other hand, is the digital counterpart, focusing on e-commerce. It gained prominence as internet shopping boomed, with Amazon (NASDAQ: AMZN) leading the trend.

Since 2019, Black Friday once again claimed the title of the most popular day for online shopping. Around 90.6 million consumers made online purchases on Black Friday, an increase from 87.2 million in 2022. In contrast, Cyber Monday saw approximately 73 million online shoppers, a slight dip from 77 million the previous year.

Stocks Worth Watching

Amazon (AMZN)

Amazon remains the undisputed king of Cyber Monday, with its sheer dominance in online sales during the holiday season. However, after a year of mixed earnings results and rising costs, all eyes are on how well the retail giant is performing this season. Strong order volumes and revenue growth could reaffirm its leadership in e-commerce, while any slowdown might raise questions about consumer spending trends.

Walmart (WMT)

Walmart continues to shine as a hybrid retail force, excelling both in physical stores on Black Friday and online during Cyber Monday. Recent efforts to expand its e-commerce reach and bolster supply chain efficiency, position Walmart for a potentially strong holiday season. Investors will be watching closely to see if these initiatives pay off and whether Walmart’s competitive pricing can maintain its market share against Amazon and Target.

Apple (AAPL)

Apple’s premium products like iPhones, AirPods, and MacBooks are always a hot ticket during Black Friday and Cyber Monday. As demand for these items often spikes, Apple’s holiday sales serve as a barometer for tech sector strength. However, with inflation pinching consumer budgets, the market will be watching to see if Apple can maintain its momentum in the face of potential price resistance.

PayPal (PYPL)

Cyber Monday is a major event for PayPal, as the surge in online transactions directly boosts its payment volumes. Following recent efforts to diversify its services and improve profitability, this holiday season is a crucial test for PayPal’s growth trajectory. Strong transaction data could signal a rebound for the stock, while weak numbers might deepen investor concerns.

Visa (V) and Mastercard (MA)

Visa and Mastercard are in their element during Black Friday and Cyber Monday, benefiting from the sheer volume of transactions processed. These credit card giants also provide insights into overall consumer spending health.

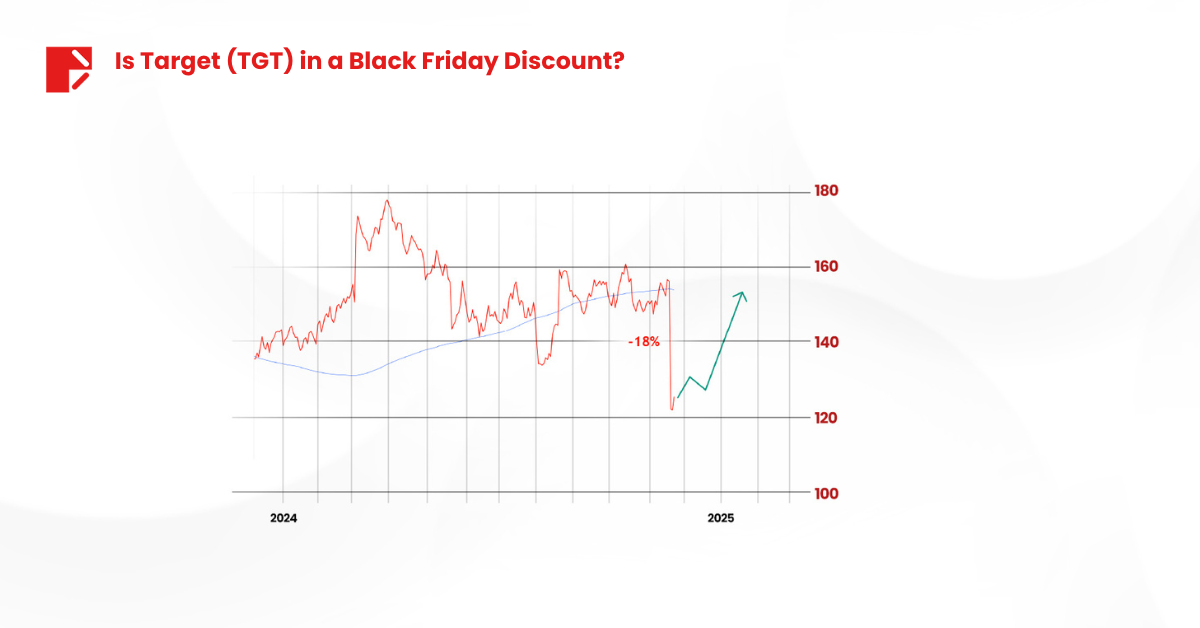

Target (TGT) In “Black Friday Discount” Mode After Earnings Miss

Target’s stock has taken a significant hit, dropping around 18% after missing earnings expectations. While shoppers might be excited about Black Friday discounts in its stores, investors are finding TGT shares trading at what feels like a discount of their own. With concerns about weaker consumer spending and tighter profit margins, Target’s performance during the holiday season will be critical in determining whether this “discount” is a buying opportunity or a warning sign for further downside.

So, Which Day Moves Markets More?

Black Friday is like the opening act, setting the stage for the holiday shopping season. It provides early insights into consumer behavior and retail performance, which can move stocks like Walmart, and Target.

Cyber Monday, however, is a laser-focused e-commerce event, with stocks like Amazon and PayPal reaping the rewards.

What Should Traders Watch For?

- Year-over-Year Sales Growth: Are shoppers spending more than last year? This can signal economic confidence—or the lack of it.

- Sector Standouts: Retail, e-commerce, and tech stocks often see the biggest action.

- Guidance Updates: Some companies revise their quarterly forecasts based on holiday sales, which can create buying or selling opportunities.

Turning Holiday Spending into Market Opportunities

The holiday shopping season offers two key moments for investors to watch closely. Black Friday gives us a first glimpse into holiday shopping trends, while Cyber Monday cements the e-commerce boom. For investors, it’s less about picking sides and more about picking the right stocks.

By paying attention to sales trends and market reactions, traders can position themselves to ride the wave of these shopping holidays. After all, when shoppers are busy filling their carts, smart investors are busy filling their portfolios.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.